We have all been there; your pay seems like a far-off memory, and the bills simply keep piling in. It is the middle of the month. Being broke mid-month is annoying and unpleasant, whether it’s an unanticipated cost, a delayed payback, or simply the cost of life catching up with you. The great news is that you no longer have to depend on friends or relatives for a temporary fix. You can quickly get money with choices like an instant credit line, simple loan app, or insta loan without embarrassing talks or emotional debt.

Why One Should Not Always Choose Asking Friends?

Though it would seem like the easiest path, borrowing from friends is uncomfortable. It can sour ties, induce unwarranted guilt, and occasionally even cause misunderstandings. Fortunately, technology has produced wiser, stress-free substitutes appropriate for daily life.

Say hello to the Insta Loan:

Now need money? An instant loan is made for precisely this. You can apply for these modest personal loans online and have minutes authorized. They’re ideal for managing unexpected costs include phone repairs, power payments that can’t wait, or medical crises. The greatest aspect is No collateral required, no paperwork, no long lines.

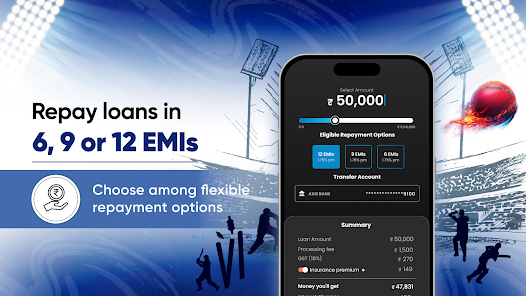

Get an Easy Loan App:

If your priorities are convenience, an easy loan app will revolutionize things. These programs follow your lending schedule, let you apply for loans straight from your phone, and even raise your credit limit over time. Easy loan apps can save the day, discreetly and fast, whether your rent is due mid-month or you simply need some breathing room for food and gasoline.

Modern apps now provide tools including rapid approval, customizable loan terms, and even zero prepayment charges. They are designed to enable common people like you handle regular money discrepancies without fuss.

Make Use of a Credit Line:

Consider your credit line as your own, always available personal emergency reserve. You do not borrow the whole amount upfront unlike with a conventional loan. Rather, you simply pay interest on the pre-approved credit limit you obtain and borrow only what you need, when you need it.

This is particularly helpful if your income is erratic or if you regularly find yourself running low on little sums of money more than once a month. A credit line provides financial breathing room free from the stress of repeatedly applying.

Loan for Salary for the Win:

Still awaiting money; but, bills are mounting. Your greatest choice could be a salary loan. These loans are intended especially for salaried workers needing a cash advance based on their monthly salary. Usually quick, approval is followed by E MI deductions or auto-debits from your salary account for payback.

Instant Credit Line:

At last, choose an instant credit line if you desire the freedom of a credit line matched to the speed of an insta loan. No judgment, no questions asked; it’s like a digital wallet full of money you could delve into whenever life veers off course.

Conclusion:

Being broke mid-month just indicates that life happens; it does not mean you are negligent. The encouraging news is you carry clever financial instruments right at hand. There is a solution out there meant to help you breathe easier and forward, whether it is an easy loan app, insta loan, salary loan, or immediate credit line—all without borrowing from pals.